PROGRESS REPORT

- Home

- Progress Report

PROGRESS REPORT

GROWTH & DEVELOPMENT

- This company was incorporated as a private company in 1993 as Parnami Credit Limited.

- In the year 2013, listed on BSE as category ‘B’ NBFC. A new Management took over and reinvented as QGO Finance Limited.

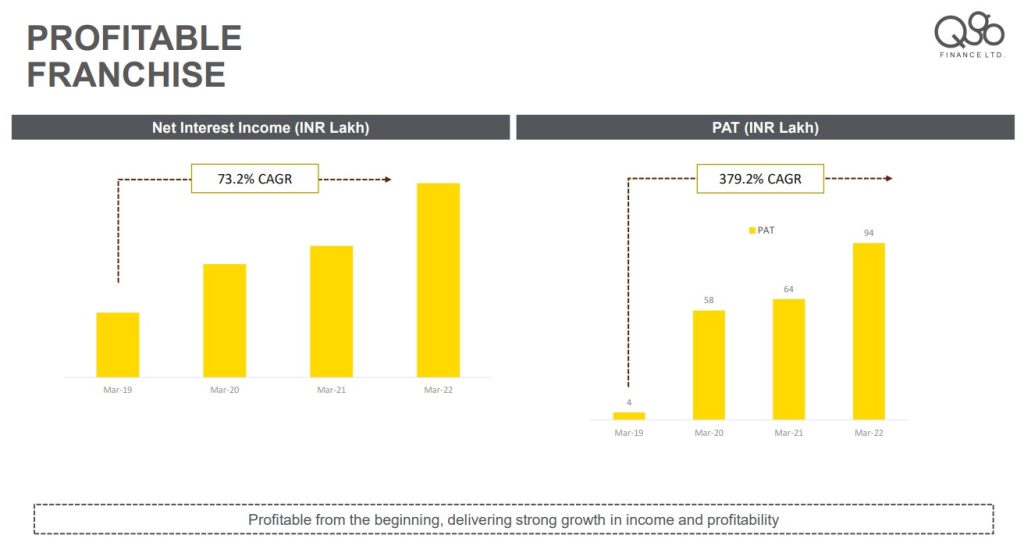

- QGO Finance has made quite a progress from the past few years. During 2018-19, the company infused equity worth INR 3.5 Crore and INR 7.75 Crore of debt has been raised via NCDs. It estimated the disbursal of its very first loan in a new avatar in August 2018. QGO closed PAT (Profit after Tax) OF INR 4 Lakhs in the year 2018-19.

- Between 2019 and 2020, 70%+ year on year growth in AUM (Asset Under Management) along with QGO’s Authorised share capital increased from INR 7 Crore to INR 10 Crore which also led to an increase INR 11.5 Crore through NCD;s at highly competitive pricing.

- In the year 2020-2021, AUM rose at INR 42.34 Crore, despite Covid 19 year on year report rose to 49% also raised INR 13.5 Crore through NCDs profitability of INR 64 Lakhs, turning ROE of 6.5%

- Meanwhile, in the year 2021-2022, all accounts are current without a single NPA (non-performing assets) throughout the year, raised INR 24.15 Crore through NCDs with profitability of 94 Lakhs, converting into an ROE of 8.58%.